Marina Harbor Report

Fire Island, NY

Dockwa data gives us a window into how boaters are exploring, booking, and returning to marinas in Fire Island and the surrounding areas.

This year’s data shows just how strong Fire Island's pull remains. Reservations rose again, driven by mid-size powerboats staying longer, booking faster, and returning to familiar docks.

The boating season may be short, but the intensity of demand rivals any destination on the East Coast.

Nightly ADR

Average LOA

Average stay

The Fire Island Boater Profile

When Boaters Visit

Fire Island sees its most intense demand between June and August, with smaller vessels (under 35 ft) driving the highest reservation volume. Despite seasonal peaks, data shows a consistent trickle of early and late-season traffic — a sign that shoulder months are becoming more viable for transient visits.

Who’s Coming to the Harbor

Powerboats dominate Fire Island waters, representing nearly 99% of all requested linear feet. The average length of vessel is 28 ft, though larger boats — particularly those in the 35–49 ft range — continue to rise in both requested nights and confirmed stays.

Where else do Fire Island boaters travel?

Boaters who spend time in Fire Island are highly mobile, visiting nearby and regional destinations throughout the summer season and snowbirding, with a preference for Florida. The most common crossover boating destinations include:

-

The Hamptons

-

Boca Raton & Pompano Beach

-

Juptier & Palm Beach

Florida

Is where Fire Island boaters are most likely to be, when not exploring Long Island

99%

Of the LF requested in Fire Island is from power boaters

$136

Is the highest ADR a Fire Island boater has paid when traveling

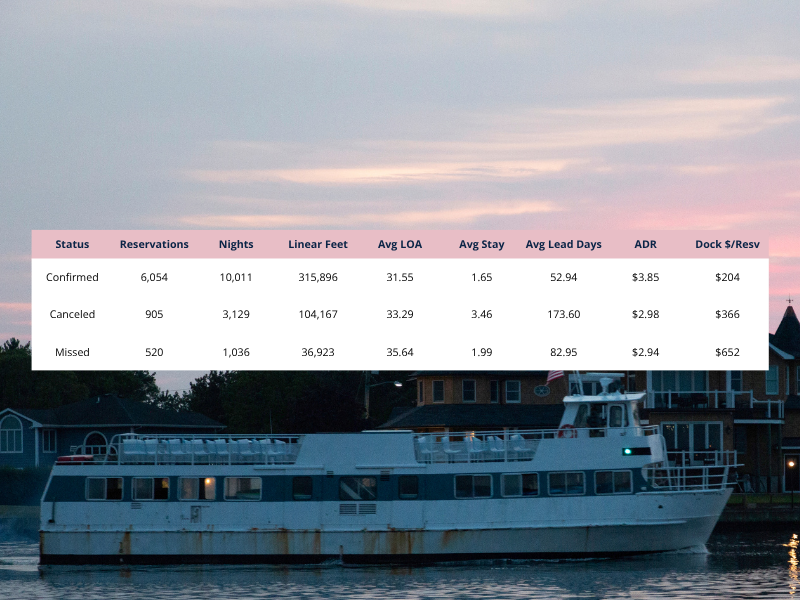

What do reservations look like in Fire Island?

In 2025, Fire Island marinas recorded over 14,000 transient nights booked, representing more than 37,000 linear feet of dockage. Confirmed transient bookings averaged a 1.65-night stay with vessels measuring 32 feet in length.

Cancellations accounted for roughly 11% of total reservations, typically involving slightly larger boats (averaging 31 feet LOA) longer requested stays, and shorter lead times, suggesting last-minute changes in plans during peak months.

Confirmed guest reservations generated an average of $204 in dockage revenue per stay. These results point to consistent mid-size boat activity and healthy seasonal demand across Fire Island’s marinas.

$204

Average dockage cost per transient stay in Fire Island

11%

Of Fire Island dockage requests are declined

1.65 nights

Average stay of a guest boater in Fire Island

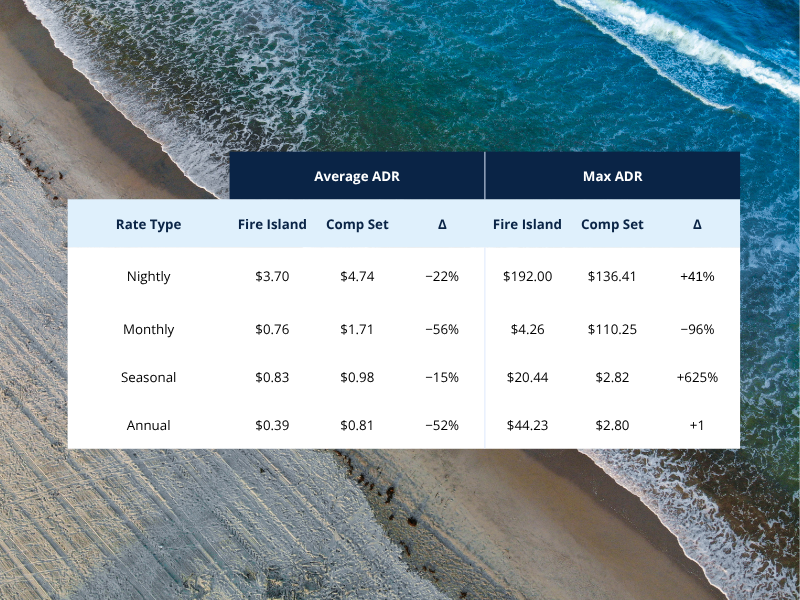

What do marinas charge in Fire Island?

The Fire Island market supports premium pricing at the height of the season, but elasticity data suggests moderate adjustments — even week to week — can drive stronger occupancy across LOA groups.

22-56%

Lower prices than what Fire Island boaters pay elsewhere for guest dockage

15%

Underpriced seasonal dockage

$192

Highest ADR charged in Fire Island

Explore More Harbor Reports

Miami

Explore boater profiles, ADRs, and more for Miami and its surrounding waters.

Dockwa Knows Marinas

50% of all Dockwa employees are former marina operators.