Marina Harbor Report

Miami, FL

Dockwa data gives us a window into how boaters are exploring, booking, and returning to marinas in Miami. From big boats to pent-up slip demand, here’s a look at what’s happening across Miami’s waterfront.

Nightly ADR

Average LOA

Average stay

The Miami Boater Profile

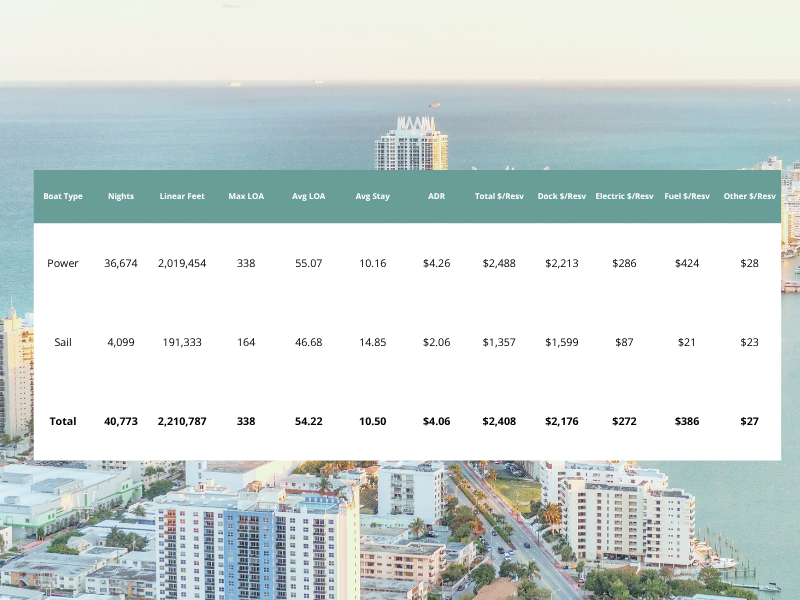

Most visiting vessels in Miami are powerboats, accounting for over 90% of reservations and nearly all linear feet reserved across local marinas. These boats are larger on average—55 feet LOA compared to 47 feet for sailboats—and stay for shorter stretches, about 10 nights per visit.

Sailboats, while representing only about 7% of total reservations, tend to stay longer—averaging 15 nights—and show longer lead times for bookings.

Overall, Miami’s mix of large, transient powerboats and smaller, longer-stay sailboats reflects a harbor built for both movement and mooring, balancing high-turnover weekend traffic with extended visits from cruising sailors.

Where else do Miami boaters travel?

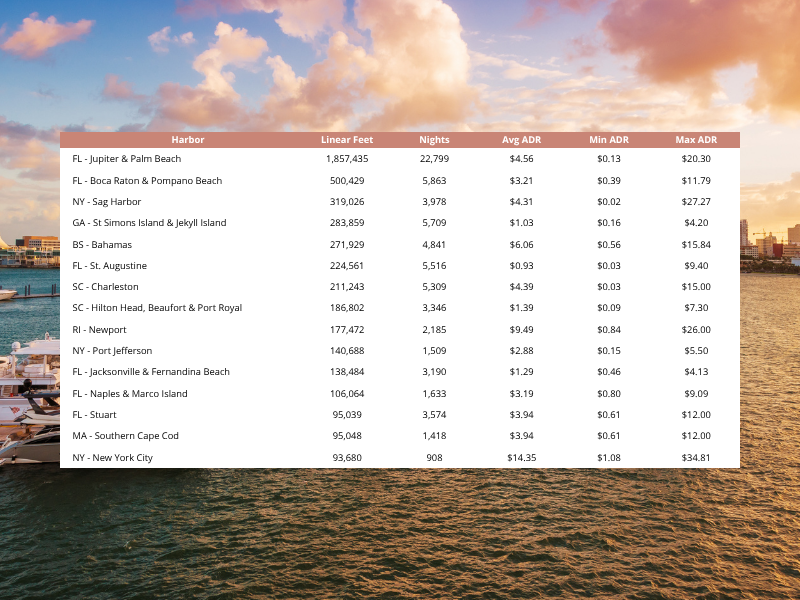

Miami’s boaters frequent destinations up and down the East Coast and across the Bahamas, with strong travel patterns between South Florida, the Carolinas, and the Northeast, reflecting both proximity cruising and seasonal migration.

The most common connections are within Florida itself—Jupiter and Palm Beach lead the list with over 1.8 million linear feet reserved, followed by Boca Raton and Pompano Beach. Outside the state, Sag Harbor, Charleston, and Newport stand out as popular northern destinations, mirroring the travel habits of snowbird boaters who split time between Miami and the Northeast.

Average daily rates (ADR) that Miami boaters pay in other destinations range widely by—from around $1 per foot in smaller harbors like St. Simons Island and St. Augustine to more than $14 per foot in New York City. The Bahamas show up prominently too, with higher ADRs and longer stays, underscoring Miami’s role as a launch point for extended island cruising.

In short, Miami marinas serve a community that doesn’t stay still for long—linking South Florida’s waters to a network of high-value, high-traffic harbors across the Atlantic coast.

Jupiter & Palm Beach

Share the most boaters with Miami

90%

Of Miami boaters are power boats

$34 Max ADR

Miami boaters are willing to pay to travel

What do reservations look like in Miami?

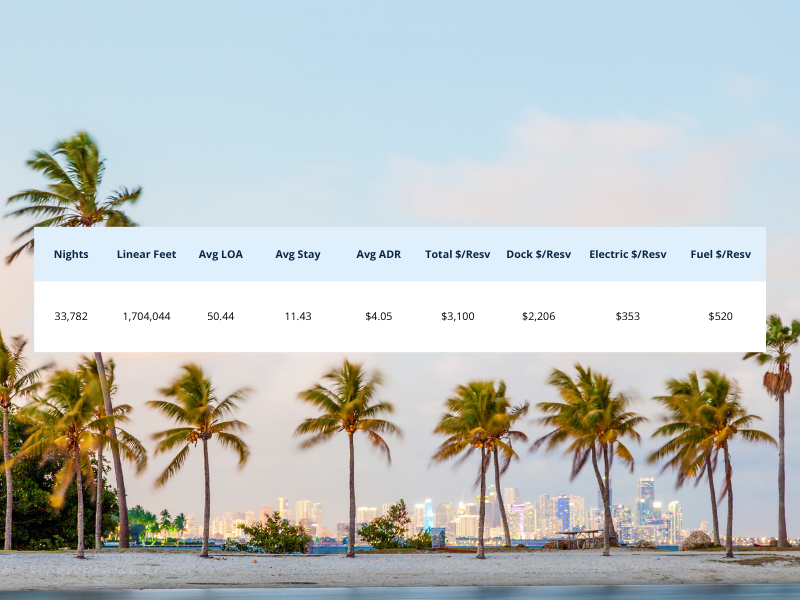

In the first 9 months of 2025, Miami marinas saw nearly 40,000 nights booked, accomodating more than 2.2 million linear feet of dockage. Confirmed bookings averaged an 11-night stay and a vessel length of 50 feet.

Cancellations made up roughly 16% of total reservations, typically involving larger boats (averaging 75 feet LOA) with shorter lead times, suggesting last-minute changes in travel plans.

Confirmed stays generated an average of $3,100 per reservation, with the majority coming from dockage fees ($2,200) and additional income from fuel and electric service. These figures underscore a steady stream of mid-length, high-value visits that drive marina revenue throughout the season.

$3100

Average spend per transient stay in Miami

16%

Of Miami reservation requests are declined

11 nights

Average stay of a boater in Miami

What do marinas charge in Miami?

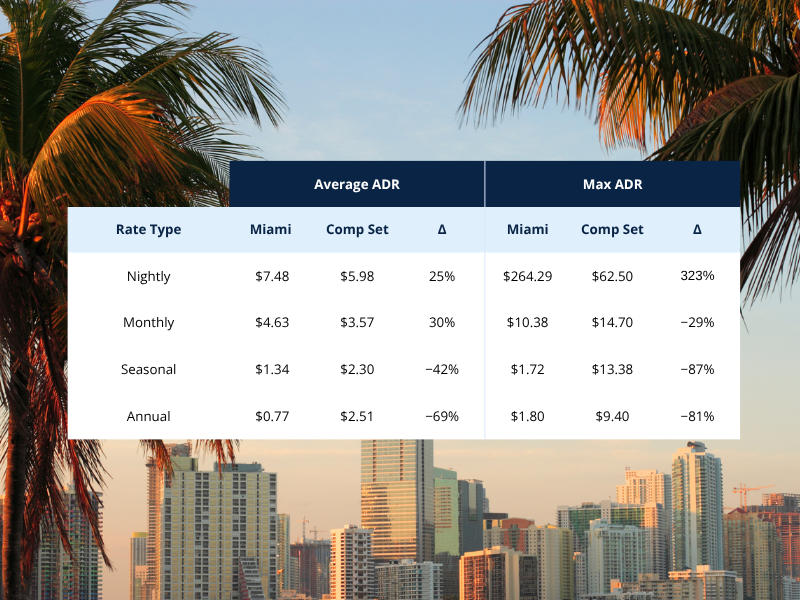

Compared to other harbors where Miami boaters travel, Miami commands a premium across all stay types, reinforcing its role as one of the most valuable and in-demand boating destinations in the region. The spread between nightly and long-term ADRs also highlights how marinas balance transient traffic with steady, year-round tenants.

25%

Premium for nightly stays in Miami

42%-69%

Underpriced long-term dockage

$264.29

Highest ADR charged in Miami

Explore More Harbor Reports

Fire Island

Explore boater profiles, ADRs, and more for Fire Island and the surrounding waters.

Dockwa Knows Marinas

50% of all Dockwa employees are former marina operators.